Navigating the world of essential health coverage as an expat is crucial for ensuring your well-being while living abroad. From understanding different coverage options to managing costs effectively, this guide provides valuable insights to help you make informed decisions about your health.

Importance of Essential Health Coverage for Expats

Having essential health coverage is crucial for expats living abroad as it provides financial protection and access to quality healthcare services in a foreign country.

Benefits of Health Coverage for Expats

- Peace of mind knowing that medical expenses will be covered in case of illness or injury

- Access to a network of healthcare providers and facilities for timely medical treatment

- Protection against unexpected healthcare costs that could be financially devastating

Risks of Not Having Proper Health Coverage

- Being denied medical treatment or facing high out-of-pocket expenses without insurance

- Delaying necessary medical care due to cost concerns, leading to worsening health conditions

- Potential legal and financial consequences in some countries for not having valid health insurance

Types of Essential Health Coverage Options for Expats

When it comes to essential health coverage options for expats, there are several types of plans available to ensure access to quality healthcare while living abroad. International health insurance and local health insurance are two primary options for expats, each with its own set of benefits and considerations.

International Health Insurance

International health insurance is designed to provide comprehensive coverage for expats living and working in different countries. This type of insurance typically offers a wide range of benefits, including coverage for medical emergencies, routine healthcare, and specialist consultations. One of the key advantages of international health insurance is the flexibility it offers in terms of coverage across multiple countries, making it ideal for expats who travel frequently or relocate often.

Local Health Insurance

Local health insurance plans are specific to the country of residence and may be more cost-effective compared to international health insurance. These plans often provide coverage for medical services within the local healthcare system, including access to hospitals and healthcare providers in the country of residence.

While local health insurance may offer more affordable premiums, it may have limitations in coverage when expats travel outside their country of residence.

Benefits of Comprehensive Health Coverage Plans

Comprehensive health coverage plans, whether international or local, offer expats peace of mind and financial protection in the event of unexpected medical expenses. These plans typically cover a wide range of medical services, including hospitalization, outpatient care, prescription medications, and emergency medical evacuation.

By having comprehensive health coverage, expats can focus on their work and personal life without worrying about the financial burden of healthcare costs.

Factors to Consider When Choosing Health Coverage as an Expat

When selecting health coverage as an expat, there are several key factors to keep in mind to ensure you have the right protection for your needs.

Coverage Limits, Deductibles, and Premiums

- Consider the coverage limits provided by the insurance plan to ensure they meet your healthcare needs, especially if you have a pre-existing condition or require specialized treatment.

- Review the deductibles to understand how much you will need to pay out of pocket before the insurance coverage kicks in.

- Compare premiums from different insurance providers to find a balance between cost and coverage benefits.

Network of Providers

- Check if the insurance plan includes a network of healthcare providers in your area or country of residence to access quality healthcare services.

- Ensure that the network includes hospitals, clinics, and specialists that can provide the medical care you may need.

Pre-existing Conditions and Emergency Medical Evacuations

- Verify if the insurance plan covers pre-existing conditions to avoid unexpected expenses related to ongoing medical treatments.

- Consider the coverage for emergency medical evacuations, especially if you are living in a remote location or traveling frequently.

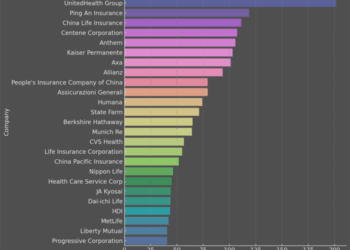

Reputation and Reliability of Insurance Providers

- Research the reputation of insurance providers by reading reviews, checking ratings, and seeking recommendations from other expats or healthcare professionals.

- Verify the reliability of insurance companies by assessing their financial stability, customer service responsiveness, and claims processing efficiency.

Tips for Managing Health Coverage Costs as an Expat

When living abroad as an expat, managing health coverage costs becomes crucial to ensure financial stability while maintaining adequate healthcare protection. Here are some strategies to help you navigate the complex world of healthcare expenses and insurance policies effectively.

Understanding Co-Payments

- Co-payments are fixed amounts that you must pay out of pocket for medical services covered by your insurance.

- By choosing a plan with higher co-payments, you can lower your monthly premiums but will need to pay more upfront for each medical visit or procedure.

- Conversely, lower co-payments result in higher premiums but reduce your out-of-pocket expenses at the time of service.

Policy Exclusions and Limitations

- It is essential to thoroughly review your health insurance policy to understand what services are excluded or have limitations.

- Being aware of these exclusions can help you avoid unexpected costs and plan for additional coverage if needed.

- Common exclusions may include pre-existing conditions, certain treatments, or elective procedures not deemed medically necessary.

Concluding Remarks

In conclusion, prioritizing essential health coverage as an expat is not just a choice but a necessity for safeguarding your health and peace of mind. By considering the tips and factors discussed in this guide, you can embark on your expat journey with confidence and security.

FAQ Summary

What are the benefits of comprehensive health coverage for expats?

Comprehensive health coverage ensures that expats have access to a wide range of medical services, including emergency care, preventive measures, and specialist consultations, providing peace of mind and security.

How can expats reduce health insurance costs?

Expats can lower health insurance costs by comparing different plans, considering higher deductibles, maintaining a healthy lifestyle, and exploring group insurance options through employers or organizations.

Why is it important to understand policy exclusions and limitations?

Understanding policy exclusions and limitations helps expats avoid unexpected costs by knowing what medical services or conditions may not be covered under their health insurance plan.