Exploring the realm of Insurance Policies That Reward Healthy Behavior, this introduction aims to captivate readers with an intriguing glimpse into how insurers are promoting health through innovative incentives.

In the subsequent paragraph, detailed information about the topic will be provided to enhance understanding.

Overview of Insurance Policies That Reward Healthy Behavior

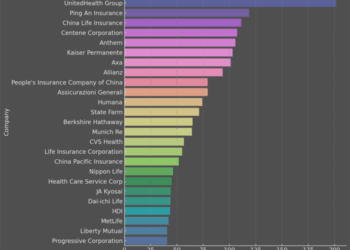

Insurance policies that reward healthy behavior are a type of insurance plan that offers incentives and rewards to policyholders who maintain or improve their health. These policies encourage individuals to adopt healthy habits and lifestyle choices by providing discounts, cash rewards, or other benefits based on their wellness activities and health outcomes.Some examples of insurance companies that offer these types of policies include John Hancock with their Vitality program, Oscar Health with their "Step" program, and UnitedHealthcare with their Motion program.

These programs typically involve tracking physical activity, nutrition, sleep, and other health-related data through wearable devices or apps to earn rewards.The benefits of insurance policies that reward healthy behavior are two-fold. For individuals, these policies promote healthier habits, leading to improved overall well-being and reduced healthcare costs in the long run.

For insurers, incentivizing healthy behavior can result in lower claims costs, improved customer satisfaction, and increased retention rates among policyholders.

Types of Rewards Offered in Insurance Policies for Healthy Behavior

Insurance companies offer a variety of rewards to encourage policyholders to adopt healthy behaviors. These incentives not only benefit the individuals but also contribute to reducing overall healthcare costs. Let's explore some of the common types of rewards and how they motivate individuals to make healthier choices.

Cash Incentives

- Insurance companies may offer cash rewards for completing health assessments, achieving fitness goals, or participating in wellness programs.

- These monetary incentives serve as a direct motivator for policyholders to engage in healthy behaviors and stay committed to their wellness journey.

Premium Discounts

- Policyholders who demonstrate healthy behaviors such as regular exercise, maintaining a healthy weight, or quitting smoking may be eligible for discounts on their insurance premiums.

- By providing financial incentives in the form of premium discounts, insurance companies encourage individuals to prioritize their health and well-being.

Rewards Points

- Some insurance policies offer rewards points that can be redeemed for gift cards, fitness equipment, or other wellness-related items.

- Accumulating rewards points through healthy behaviors creates a sense of achievement and encourages individuals to continue making positive lifestyle choices.

Health Savings Account Contributions

- Policyholders who engage in healthy behaviors may receive contributions to their health savings account, which can be used to cover medical expenses not covered by insurance.

- By incentivizing individuals to prioritize preventive care and wellness, insurance companies help them build financial security for future healthcare needs.

Tracking and Monitoring Healthy Behavior

Insurance companies utilize various methods to track and monitor healthy behaviors of their policyholders in order to offer rewards and incentives for maintaining a healthy lifestyle.

Role of Technology in Tracking Behaviors

- Wearable Devices: Insurance companies often provide policyholders with wearable devices such as fitness trackers or smartwatches to monitor their physical activity, heart rate, and sleep patterns.

- Mobile Apps: Many insurance companies have developed mobile apps that allow users to log their exercise routines, food intake, and other health-related activities to track their progress.

- Data Analytics: By analyzing the data collected from wearable devices and mobile apps, insurance companies can gain insights into the lifestyle choices and behaviors of their policyholders.

Privacy Implications of Tracking and Monitoring Systems

- Consent: Policyholders must provide explicit consent for insurance companies to track and monitor their healthy behaviors, ensuring transparency and compliance with privacy regulations.

- Data Security: Insurance companies are responsible for safeguarding the personal health data collected from policyholders, implementing strict security measures to prevent unauthorized access or data breaches.

- Anonymization: To protect the privacy of policyholders, insurance companies may anonymize the collected data before using it for analysis or rewarding healthy behaviors.

Impact of Insurance Policies on Public Health

Insurance policies that reward healthy behavior have a significant impact on public health by incentivizing individuals to adopt healthier habits and lifestyles. These policies not only encourage preventive measures but also help reduce the burden on healthcare systems by promoting overall well-being.

Examples of Successful Public Health Initiatives Driven by Insurance Incentives

- Incentivizing regular exercise by offering discounts on premiums for hitting fitness goals.

- Providing lower co-pays for individuals who undergo preventive health screenings regularly.

- Rewarding healthy eating habits by offering cashback on purchases of nutritious foods.

Potential Challenges or Criticisms of Using Insurance Rewards for Promoting Health

- Some critics argue that these incentives may disproportionately benefit wealthier individuals who can afford healthier options.

- There is concern that focusing on individual behavior may overlook systemic factors that contribute to health disparities.

- Privacy issues may arise when insurers collect data on individuals' health behaviors to determine rewards.

Final Wrap-Up

Concluding our discussion on Insurance Policies That Reward Healthy Behavior, we reflect on the impact of incentivizing wellness and leave readers with a compelling summary of the key points discussed.

Quick FAQs

How do insurance policies that reward healthy behavior work?

These policies typically offer incentives or rewards to individuals who engage in healthy activities, such as exercise or preventive screenings.

Which insurance companies are known for offering policies that reward healthy behavior?

Some well-known companies include Aetna, UnitedHealthcare, and Humana, among others.

What are the privacy implications of tracking healthy behaviors for insurance rewards?

Tracking systems may raise concerns about data privacy and the potential misuse of personal information. Insurers must adhere to strict privacy regulations to safeguard individuals' data.