Embark on a journey through the top wellness-based insurance programs in 2025, delving into the evolving landscape of health and insurance. From technological advancements to global trends, this guide covers it all with a mix of informative insights and engaging content.

Overview of Wellness-Based Insurance Programs in 2025

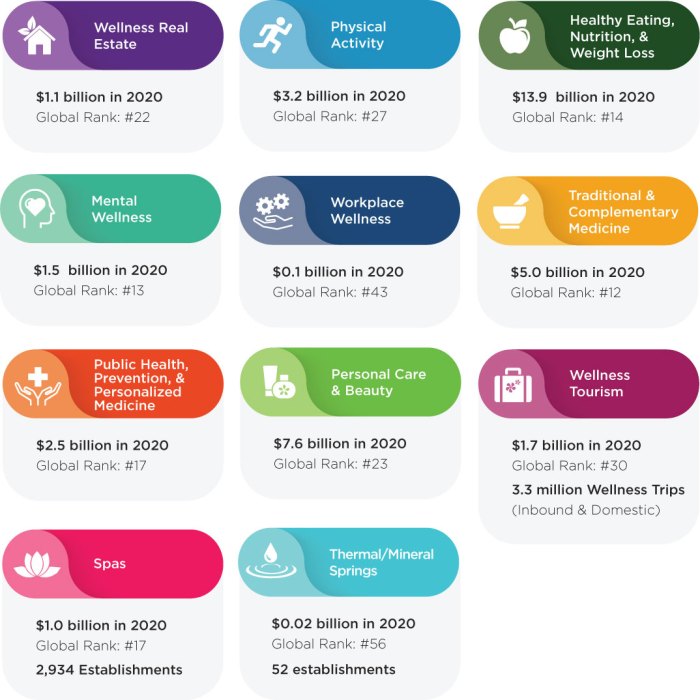

Wellness-based insurance programs in 2025 refer to insurance plans that focus on promoting and incentivizing healthy behaviors and lifestyles among policyholders. These programs are designed to prevent illness, manage chronic conditions, and improve overall health and well-being.

The evolution of wellness programs within insurance has seen a shift from traditional models that primarily focused on treating illnesses to a more proactive approach that emphasizes prevention and holistic wellness. Insurance companies now recognize the value of investing in their policyholders' health to reduce long-term healthcare costs and improve quality of life.

Key Components of Wellness-Based Insurance Programs

- Personalized Wellness Plans: Insurance programs now offer personalized wellness plans tailored to individual policyholders based on their health needs, goals, and preferences.

- Health Tracking Technology: Many wellness-based insurance programs utilize health tracking technology such as wearables and mobile apps to monitor and incentivize healthy behaviors.

- Preventive Care Benefits: These programs often include coverage for preventive care services such as screenings, vaccinations, and wellness visits to help policyholders stay ahead of potential health issues.

- Healthy Lifestyle Incentives: Insurance companies may offer incentives such as premium discounts, cash rewards, or gym memberships to encourage policyholders to adopt and maintain healthy lifestyle choices.

- Telehealth Services: Wellness-based insurance programs may provide access to telehealth services for virtual consultations with healthcare providers, making healthcare more convenient and accessible.

Technological Advancements Impacting Wellness-Based Insurance

Technology is revolutionizing the landscape of wellness programs in the insurance industry, offering innovative solutions to enhance health outcomes and reduce costs for both insurers and policyholders.

Role of Wearables and Health Tracking Devices in Insurance

Wearables and health tracking devices have become integral tools in wellness-based insurance programs. These devices collect real-time data on various health metrics such as heart rate, activity levels, and sleep patterns. Insurers utilize this data to incentivize policyholders to adopt healthy behaviors by offering rewards or discounts based on their activity levels.

By promoting preventive care and early intervention, wearables help insurers mitigate risks and reduce healthcare expenses in the long run.

Integration of AI and Data Analytics in Wellness Programs

Artificial Intelligence (AI) and data analytics play a crucial role in analyzing large volumes of health data to personalize wellness programs for individuals. AI algorithms can identify patterns, predict health risks, and suggest personalized interventions to improve health outcomes. By leveraging AI and data analytics, insurers can tailor wellness programs to meet the specific needs of policyholders, leading to better engagement and adherence to healthy habits.

Additionally, AI-driven chatbots and virtual assistants provide round-the-clock support, guidance, and motivation to policyholders on their wellness journey.

Popular Wellness Incentives Offered by Insurance Programs

Insurance programs have been increasingly incorporating wellness incentives to encourage policyholders to adopt healthier lifestyles. These incentives can range from premium discounts to rewards for achieving specific wellness goals. Let's delve into some of the popular wellness incentives offered by insurance programs.

Premium Discounts

- Insurance programs often provide premium discounts to policyholders who actively participate in wellness activities such as regular exercise, healthy eating, and preventive health screenings.

- These discounts serve as a financial incentive for individuals to prioritize their health and well-being, ultimately leading to reduced healthcare costs for both the policyholder and the insurance provider.

Rewards for Wellness Goals

- Some insurance programs offer rewards, such as gift cards or cash incentives, to policyholders who successfully achieve specific wellness goals, such as weight loss, smoking cessation, or improved fitness levels.

- These rewards not only motivate individuals to make positive lifestyle changes but also reinforce healthy behaviors by acknowledging and celebrating their accomplishments.

Health Challenges and Competitions

- Insurance programs may organize health challenges or competitions that encourage policyholders to engage in activities like step challenges, nutrition tracking, or stress management techniques.

- By fostering a sense of community and friendly competition, these initiatives promote accountability, social support, and overall well-being among participants.

Effectiveness of Incentives

- Research has shown that wellness incentives offered by insurance programs can lead to improved health outcomes, increased engagement in preventive care, and overall cost savings in the long run.

- By incentivizing healthy behaviors, insurance programs not only benefit the individual policyholder but also contribute to a healthier population and reduced healthcare expenses for society as a whole.

Global Trends and Adoption of Wellness-Based Insurance Programs

Wellness-based insurance programs have been gaining traction worldwide, with varying adoption rates and trends shaping the insurance industry on a global scale.

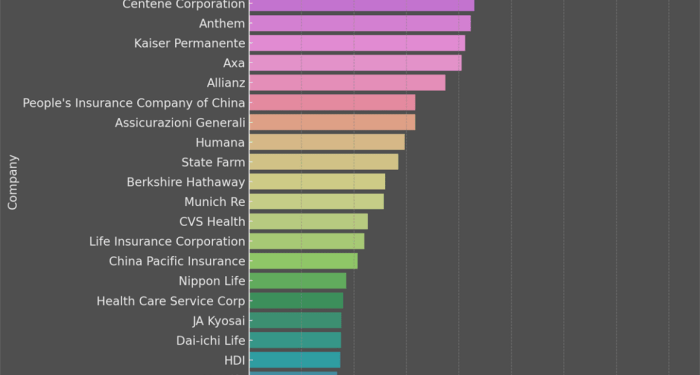

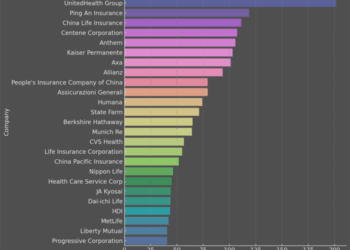

Adoption Rates of Wellness Insurance Programs Worldwide

Wellness insurance programs have seen significant adoption rates in developed countries such as the United States, Canada, and countries in Western Europe. These regions have embraced the concept of preventive healthcare and are actively incorporating wellness incentives into their insurance offerings.

Trends in Different Regions and Impact on the Insurance Industry

- North America: In North America, there is a growing trend towards employer-sponsored wellness programs as a way to reduce healthcare costs and improve employee productivity. Insurance companies are partnering with employers to offer tailored wellness solutions.

- Asia-Pacific: Countries in the Asia-Pacific region are also witnessing an increase in the adoption of wellness insurance programs. Governments are promoting healthy living initiatives, leading to collaborations between insurers and public health agencies.

- Latin America: In Latin America, there is a shift towards personalized wellness programs that cater to the specific health needs of individuals. Insurance providers are leveraging technology to offer customized solutions.

- Europe: European countries are focusing on integrating wellness programs into their national healthcare systems to promote overall well-being and reduce healthcare expenditures. Insurers are working closely with policymakers to implement these initiatives.

Cultural Differences Affecting the Implementation of Wellness Programs

Cultural differences play a significant role in the implementation of wellness programs around the world. In some regions, there may be hesitancy towards sharing personal health data, while in others, there is a strong emphasis on community-based wellness activities. Insurance companies need to consider these cultural nuances when designing and promoting their wellness-based insurance programs.

Conclusion

In conclusion, the world of wellness-based insurance programs in 2025 offers a promising future for health-conscious individuals. With a focus on incentives, technology, and global adoption, these programs are reshaping the insurance industry for the better. Dive in and discover the potential that awaits in the realm of wellness and insurance.

Key Questions Answered

What are some common wellness incentives offered by insurance programs?

Common incentives include premium discounts, rewards for achieving health goals, and access to fitness programs.

How is technology impacting wellness-based insurance programs?

Technology is revolutionizing these programs through wearables, health tracking devices, and the integration of AI for data analytics.

What cultural differences affect the implementation of wellness programs?

Cultural attitudes towards health and wellness, as well as perceptions of insurance, can influence how these programs are adopted and utilized.