Delving into the realm of private insurance plans, Understanding Wellness Packages in Private Insurance Plans sheds light on the intricacies of incorporating wellness programs into insurance coverage. Brace yourself for an enlightening journey through the world of health and well-being within the insurance landscape.

Overview of Wellness Packages in Private Insurance Plans

Wellness packages in private insurance plans are designed to promote and support the overall health and well-being of policyholders. These packages typically include a range of preventive services and programs aimed at helping individuals maintain a healthy lifestyle and prevent the onset of chronic diseases.

Examples of Wellness Services

- Annual physical exams

- Health screenings (e.g., cholesterol, blood pressure)

- Nutrition counseling

- Weight management programs

- Smoking cessation support

- Fitness classes or gym memberships

Importance of Wellness Programs

Wellness programs play a crucial role in empowering policyholders to take charge of their health and make informed decisions about their well-being. By incorporating wellness services into insurance plans, individuals are encouraged to engage in preventive care, leading to early detection of health issues and better health outcomes.

Benefits of Wellness Packages

- Reduced healthcare costs in the long run by preventing costly medical treatments

- Improved overall health and quality of life for policyholders

- Enhanced productivity and decreased absenteeism in the workplace

- Increased customer satisfaction and loyalty towards the insurance company

Coverage and Eligibility Criteria

Wellness packages in private insurance plans offer a range of coverage options to policyholders, focusing on preventive care and promoting overall well-being.

Coverage Provided

- Regular health screenings and check-ups

- Nutritional counseling and diet plans

- Physical fitness programs and gym memberships

- Mental health services such as counseling and therapy

- Smoking cessation programs

Eligibility Criteria

- Policyholders typically need to be enrolled in a specific insurance plan that includes wellness benefits.

- Some plans may require policyholders to meet certain health criteria or risk factors to qualify for wellness services.

- Age restrictions may apply for certain wellness programs, such as fitness classes or screenings.

Limitations and Restrictions

- Coverage for wellness services may be subject to annual limits or maximum benefit amounts.

- Not all wellness programs or services may be covered under every insurance plan, leading to variations in available benefits.

- Policyholders may need to obtain pre-authorization or referrals for certain wellness services to ensure coverage.

Cost and Affordability

When it comes to private insurance plans, the cost of wellness packages is determined based on several factors. These may include the type and extent of coverage offered, the specific services included in the package, as well as the overall risk profile of the policyholder.

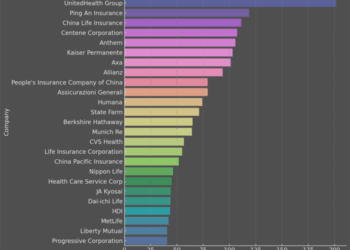

Comparison of Affordability Across Providers

Insurance providers may offer wellness packages at varying costs, depending on their pricing strategies and target market. It is essential for policyholders to compare the affordability of wellness packages across different providers to ensure they are getting the best value for their money

Cost-sharing Mechanisms and Incentives

Some insurance plans may have cost-sharing mechanisms in place to make wellness packages more affordable for policyholders. This could include co-payments, where the policyholder pays a fixed amount for each service received, or coinsurance, where the policyholder pays a percentage of the total cost.

Customization and Flexibility

Wellness packages in private insurance plans offer the flexibility to be customized according to individual policyholder needs. This allows for a more personalized approach to healthcare and wellness.

Flexible Options in Wellness Packages

- Customizable Coverage: Policyholders can choose specific wellness services and programs based on their health goals and needs.

- Alternative Therapies: Some packages may include options for alternative therapies such as acupuncture, chiropractic care, or massage therapy.

- Wellness Coaching: Certain plans offer wellness coaching services to help individuals set and achieve their health and wellness goals.

- Fitness Programs: Access to fitness classes, gym memberships, or virtual workout sessions may be included in some wellness packages.

Importance of Personalized Wellness Solutions

Personalized wellness solutions are crucial in insurance plans as they address the unique health concerns and goals of each policyholder. By offering customization and flexibility, insurance companies can better support individuals in maintaining and improving their overall well-being.

Integration with Health Benefits

Wellness packages in private insurance plans are often designed to complement and enhance existing health benefits for policyholders. By integrating wellness programs with traditional health coverage, insurance companies aim to promote proactive healthcare practices and preventive measures among their members.

This integration creates a holistic approach to healthcare that focuses on both prevention and treatment, leading to improved overall health outcomes for policyholders.

Synergies between Wellness Programs and Traditional Health Coverage

Wellness programs and traditional health coverage work together to provide comprehensive healthcare solutions to policyholders. While traditional health coverage focuses on diagnosing and treating illnesses, wellness programs emphasize preventive care and lifestyle management. This combination helps individuals maintain good health, prevent chronic conditions, and manage existing health issues effectively.

Impact of Wellness Initiatives on Overall Health Outcomes

By encouraging policyholders to participate in wellness initiatives such as health screenings, fitness programs, nutrition counseling, and stress management workshops, insurance companies can significantly impact overall health outcomes. These initiatives help individuals adopt healthier habits, improve their quality of life, and reduce the risk of developing serious health conditions.

As a result, policyholders may experience fewer hospitalizations, lower healthcare costs, and better long-term health outcomes.

Final Review

In conclusion, Understanding Wellness Packages in Private Insurance Plans unravels the significance of holistic well-being in insurance schemes, offering a transformative perspective on the intersection of health and coverage. As we navigate the evolving landscape of insurance offerings, the integration of wellness packages stands as a beacon of hope for policyholders seeking comprehensive care.

General Inquiries

How are wellness packages different from traditional health coverage?

Wellness packages focus on preventive services and promoting overall well-being, while traditional health coverage typically addresses medical treatment for illnesses.

Can policyholders choose specific wellness services within a package?

Yes, many insurance providers allow policyholders to customize their wellness packages based on individual needs and preferences.

Are there any incentives for policyholders to participate in wellness programs?

Some insurance plans offer incentives such as premium discounts or rewards for policyholders who actively engage in wellness activities.

Do wellness packages cover mental health services?

While some wellness packages may include mental health services, coverage can vary among different insurance providers. It's important to review the specific details of each plan.